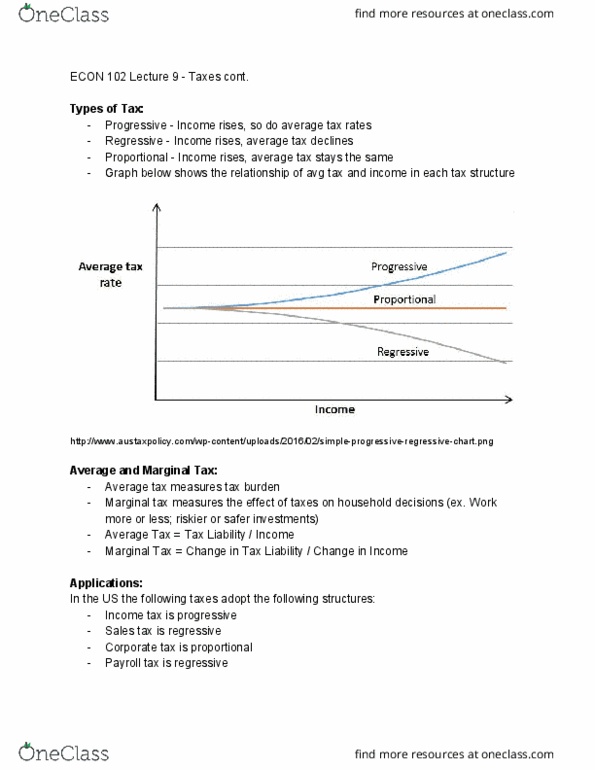

46. In a proportional income tax system,

marginal tax rates increase as the level of taxable income increases.

marginal tax rates are the same regardless of the level of taxable income.

everyone pays the same dollar amount in taxes.

marginal tax rates decline as the level of taxable income declines.

47 A tax system that applies a lower marginal tax rate at higher levels of income is

backward.

regressive.

progressive.

proportional.

48 The average tax rate can be calculated by which of the following formulas?

The change in taxes due divided by the change in taxable income

The change in taxable income divided by the change in taxes due

Total taxable income divided by total taxes due

Total taxes due divided by total taxable income

49 Under a progressive income tax system, the marginal income tax rate paid by taxpayers

declines as their incomes increase

. is unrelated to their incomes.

rises as their incomes increase.

is unchanged as their incomes increase.

50 The tax base is the minimum amount of tax revenue that government must collect each year.

the maximum amount of tax revenue that government must collect each year.

the sum of all incomes earned in the United States.

the value of all goods, services, incomes, or wealth subject to taxation.

51 A capital gain is defined as the tax paid when one sells an asset.

the tax rate one pays when one moves into a higher tax bracket.

an unanticipated increase in income.

the positive difference between the sale price and the purchase price of an asset.

52 Corporate profits are

taxed twiceonce by the corporate tax system, and again by personal tax system when they are paid to stockholders as dividends.

taxed only when a stockholder sells his or her shares of stock.

taxed at too low a rate.

taxed three timesonce by the corporate tax system, again by the personal tax system, and again as capital gains.

53 Social Security taxes are regressive because

they apply only to rich people.

they are not applied to income beyond a certain amount.

they are applied to welfare recipients.

they are applied to retired people only.

54 The largest share of federal government tax receipts is derived from

excise taxes.

individual income taxes.

corporate income taxes.

social insurance contributions.

55 Local government expenditures depend on which taxes?

Social Security taxes

Local property, sales, and excise taxes

Capital gains taxes

Revenues from licenses and permits

56 When the purchase price of an asset is less than its sale price, then there is a

budget deficit.

corporate income tax.

capital gain.

capital loss.

57 The earnings that a corporation saves for investment in other productive activities are

transfers in kind. c

apital gains.

tax incidence.

retained earnings.

58 Tax incidence refers to

determining who sends the taxes into the government.

the distribution of tax burdens among groups, or who really pays a tax.

the tendency of some people to avoid paying taxes at all.

determining the marginal tax rate applied to any increase in income.

59 Social Security taxes are paid by

neither employers nor employees

both employers and employees.

employers only.

employees only.