BUS-A 100 Lecture Notes - Lecture 12: Financial Statement, Fixed Cost, Income Statement

BUS-A 100 verified notes

12/14View all

Document Summary

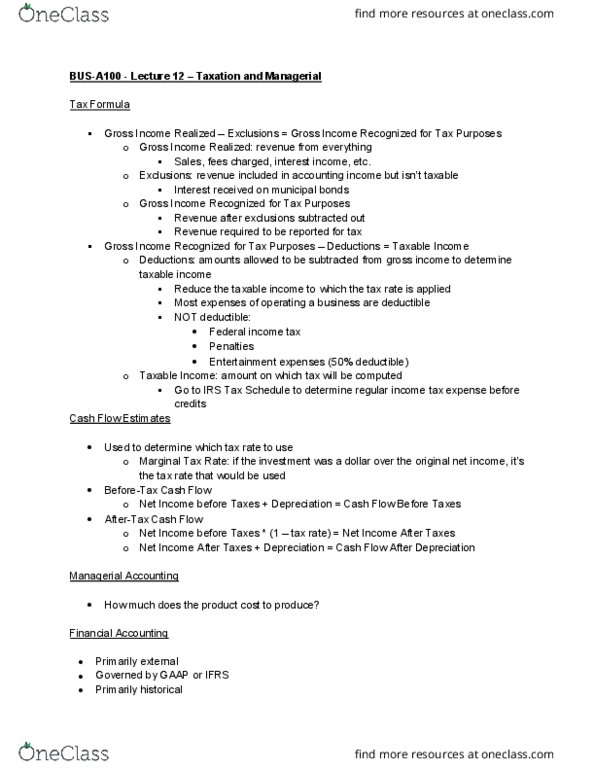

Bus-a100 - lecture 12 taxation and managerial. Tax formula: gross income realized exclusions = gross income recognized for tax purposes, gross income realized: revenue from everything, sales, fees charged, interest income, etc, exclusions: revenue included in accounting income but isn"t taxable. Financial accounting: primarily external, governed by gaap or ifrs, primarily historical, mostly quantified info for financial statements. Cost of inventory: dm + dl + moh = product costs, dm: direct materials, materials used to make the company"s product, dl: direct labor, cost of the people working on the product, moh: manufacturing overhead. Indirect materials: materials that the company uses, but, not to make product. Indirect labor: salaries and wages, those who don"t work directly on the product, all other manufacturing costs. Includes: direct materials, direct labor, variable manufacturing overhead, variable selling, administrative costs, variable costs: costs that vary in direct relationship w/ volume produced, fluctuate with volume produced, stay same per unit produced.