Question 1

The higher the capital utilization rate, the greater the depreciation rate.

Question 2

Higher capital utilization rates may raise the user costs of capital because higher utilization rates imply

| operating at inconvenient times. |

| paying overtime to employees operating the machines. |

| operating when complementary services like transporters are unavailable or more expensive. |

Question 3

If the rental price of capital increase, the capital utilization rate

| depends on whether the substitution rate is greater than the income effect |

Question 4

The vacancy rate in the labor market is

| the number of job openings divided by the number of unemployed people in the labor force. |

| the number of job openings divided by the number of workers in the labor force. |

| the ratio of open jobs to filled jobs. |

| the ratio of open jobs to the total number of jobs that employers want occupied. |

Question 5

Unemployment can exist in a market clearing model if it takes some search time for workers to find jobs.

Question 6

A decrease in workersâ effective real incomes while they are unemployed will

| lower the job finding rate and raise the expected duration of unemployment. |

| lower the job finding rate and the expected duration of unemployment. |

| raise the job finding rate and lower the expected duration of unemployment. |

| raise the job finding rate and the expected duration of unemployment. |

Question 7

In the Barro model, the natural rate of unemployment is

| positively related to the job separations rate. |

| positively related to the job finding rate. |

Question 8

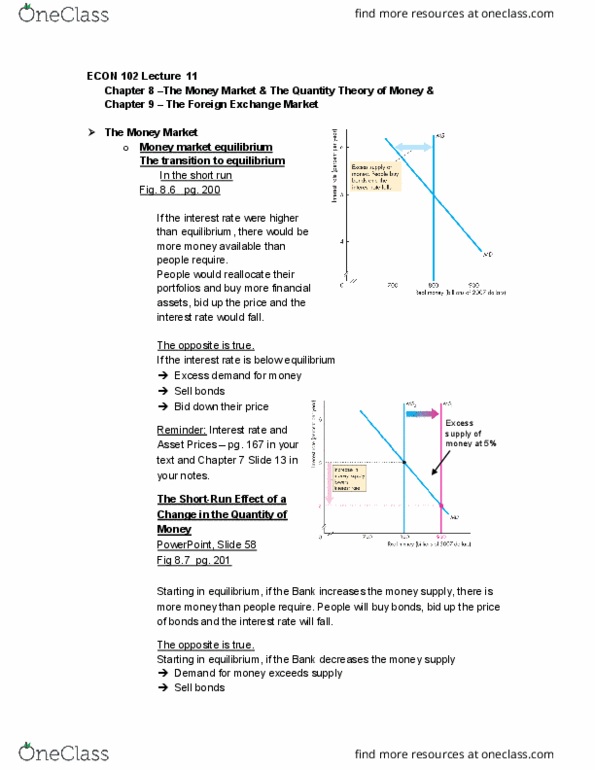

If the interest rate increases, the real demand for money also increases

Question 9

Commodity money is money that has value because

| of the intrinsic value of the commodity. |

Question 10

High-powered money is

| money held by business for investment. |

| total currency in circulation plus depository institution deposits at the Fed. |

| total currency in circulation. |

| government bonds held by the public and depository institutions. |

Question 11

U.S. M1 money includes

| currency held by the public. |

Question 12

U.S. M2 money includes

| currency, time deposits, and government bonds. |

| savings deposits, small time deposits, and private bonds. |

| checkable deposits, savings deposits, and small time deposits. |

| retail money market mutual funds, small time deposits, and government bonds. |

Question

Money is different from other assets like capital and bonds in that

| money does not pay interest. |

| money has intrinsic value. |

| money is a better long term store of value. |

Question

If a personâs income doubles, we expect their cash holdings to

Question 15

Real money demand does not change when

| the interest rate changes. |

Question 16

All else constant, the price level rises when the supply of money increases.

Question 17

If the nominal interest rate were to increase, then

| money demand decreases and the price level increases. |

| money demand increases and the price level decreases. |

| the money supply and the price level would increase. |

| the money supply and the price level would decrease. |

Question 18

Real money demand is a function of real GDP and the nominal interest rate.

Question 19

The real return on money is zero.

Question 20

If the expected inflation rate is 5% and the unexpected inflation rate is 4%, the actual inflation is

Question 21

When the rate of growth of money is constant

| the inflation rate equals the growth rate of money. |

| the nominal interest rate rises. |

| real money balances are declining. |

Question 22

A decrease in the money growth rate in the market clearing model causes

| a decrease in the nominal interest rate. |

| an increase in money demand. |

| a decrease in the price level. |

Question 23

A decrease in the money growth rate in the market clearing model causes

| an increase in the nominal interest rate. |

| an increase in money demand. |

| an increase in the price level. |

Question 24

Under price level targeting the money supply becomes

Q 25 During a recession, the interest rate falls tending to cause money demand to rise, but is at least partly offset by real GDP falling tending to cause money demand to fall.