AFM101 Lecture Notes - Lecture 5: Costco, Revenue Recognition, Matching Principle

AFM101 verified notes

5/21View all

Document Summary

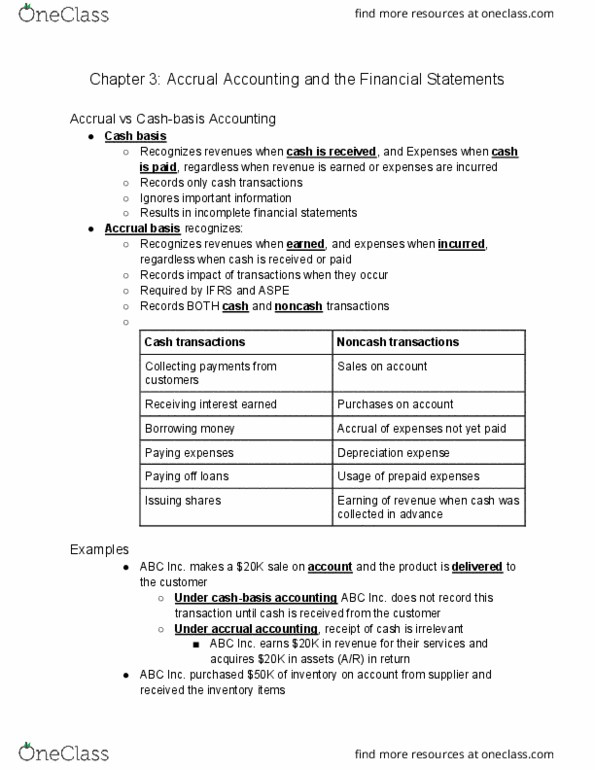

Chapter 3: accrual accounting and the financial statements. Recognizes revenues when cash is received, and expenses when cash is paid, regardless when revenue is earned or expenses are incurred. Recognizes revenues when earned, and expenses when incurred, regardless when cash is received or paid. Records impact of transactions when they occur. Earning of revenue when cash was collected in advance. Abc inc. makes a k sale on account and the product is delivered to the customer. Under cash-basis accounting abc inc. does not record this transaction until cash is received from the customer. Abc inc. earns k in revenue for their services and. Abc inc. purchased k of inventory on account from supplier and acquires k in assets (a/r) in return received the inventory items. Under cash-basis accounting abc inc. does not record this transaction until it pays k to its suppliers. Under accrual accounting, receipt of cash is irrelevant.