COMM 1101 Lecture Notes - Lecture 26: Current Liability, Cash Flow, Working Capital

COMM 1101 verified notes

26/26View all

Document Summary

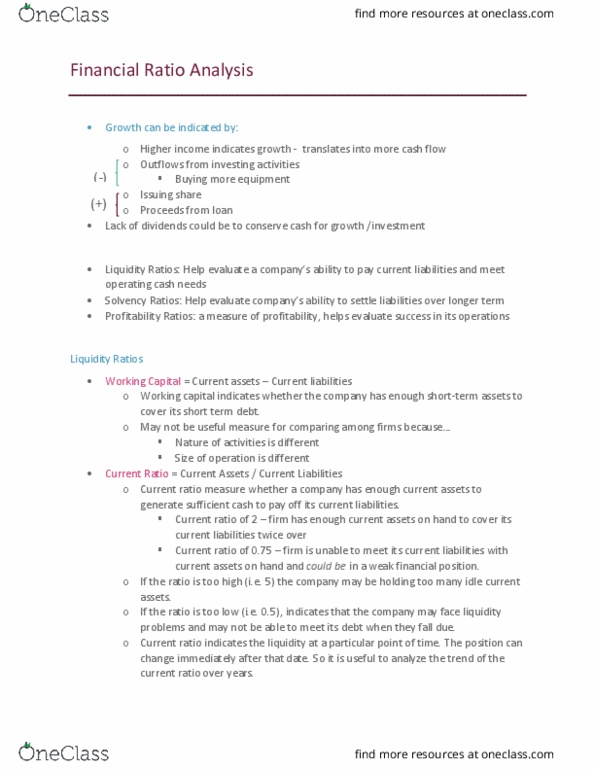

Financial ratio analysis: growth can be indicated by, higher income indicates growth - translates into more cash flow, outflows from investing activities, buying more equipment. If the ratio is too high (i. e. 5) the company may be holding too many idle current assets. The position can change immediately after that date. Inventory turnover = cost of goods sold / average inventory. Inventory turnover measure the sale ability of inventory the number of times a company sells its average inventory level during a year: high inventory turnover ratio indicated that the product is selling well, varies with industry. Solvency ratios: solvency ratio measures used to evaluate a firm"s ability to pay its debt over the longer term, debt to total asset ratio = total liabilities / total assets. 2: debt to total asset ratio indicates what proportion of debt a company has relative to its assets, the debt to total asset ratio can help investors determine a company"s level of risk.