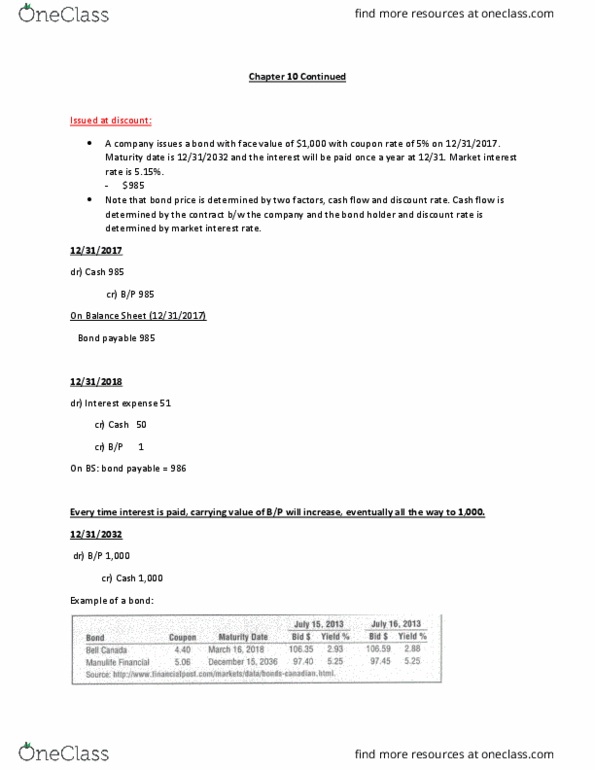

Issued at discount: a company issues a bond with face value of ,000 with coupon rate of 5% on 12/31/2017. : note that bond price is determined by two factors, cash flow and discount rate. 12/31/2018 dr) interest expense 51 cr) cash 50 cr) b/p 1. Every time interest is paid, carrying value of b/p will increase, eventually all the way to 1,000. Issued at par: a company issues a bond with face value of ,000 with coupon rate of 5% on 12/31/2017. 1000: note that bond price is determined by two factors, cash flow and discount rate. 12/31/2018 dr) interest expense 50 cr) cash 50. Two ways to amortize discount on b/p (i. e. , ); straight-line method and effective interest rate method. Whatever method you use, the amortization of discount on b/p will increase interest expense. Issued at premium: a company issues a bond with face value of ,000 with coupon rate of 5% on 12/31/2017.