angadbhatia1243

0 Followers

0 Following

0 Helped

21 Nov 2023

Answer: To prepare a cost of goods manufactured schedule for Clarkson Company,...

21 Nov 2023

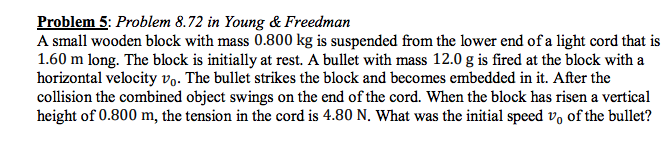

Answer: Let's denote the initial speed of the bullet as �0V0, the mass of the...

21 Nov 2023

Answer: 1. Taylor Products Company: a. Manufacturing Costs for the Year: Direc...

21 Nov 2023

Answer: Step-by-step explanation: I understand that you need assistance with a...

21 Nov 2023

Answer: Step-by-step explanation: Introduction: Cloud computing has revolution...

21 Nov 2023

Answer: Step-by-step explanation: The Hurst exponent (H) is often used to char...

21 Nov 2023

Answer: risk assessment Step-by-step explanation: a. Risk Assessment on the Ad...