ECON 1201 Lecture 17: Taxes and Externalities

ECON 1201 verified notes

17/28View all

Document Summary

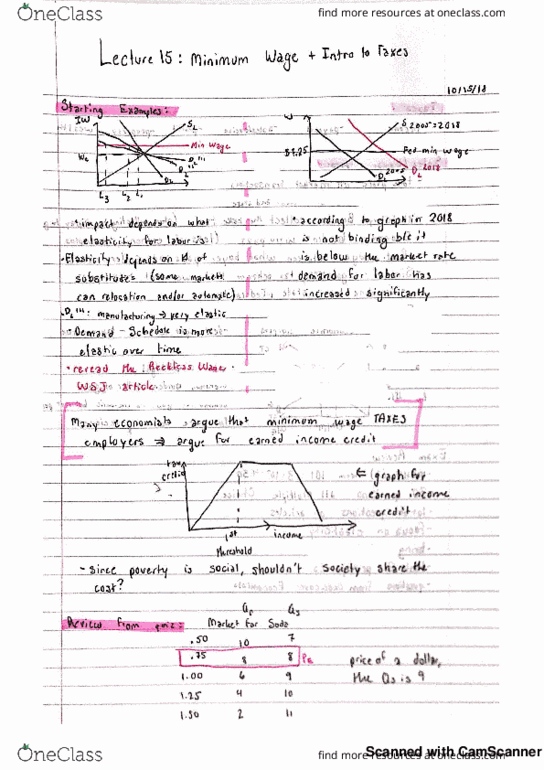

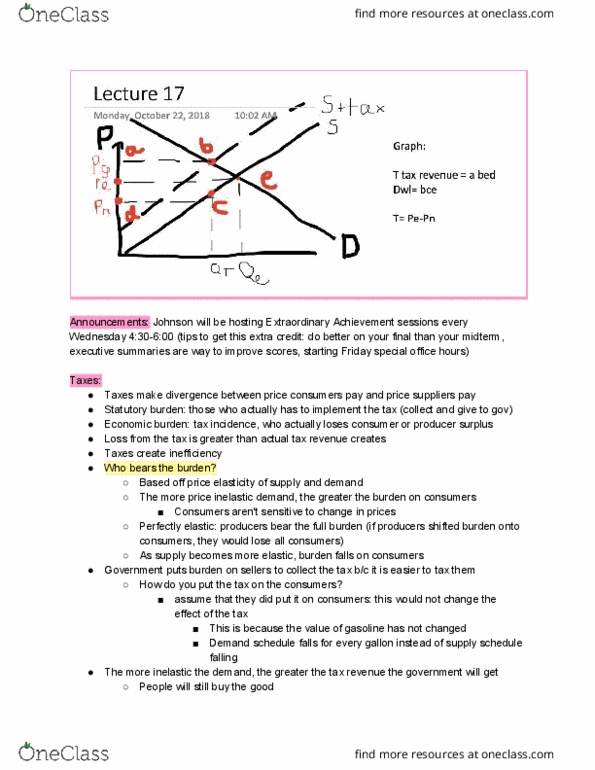

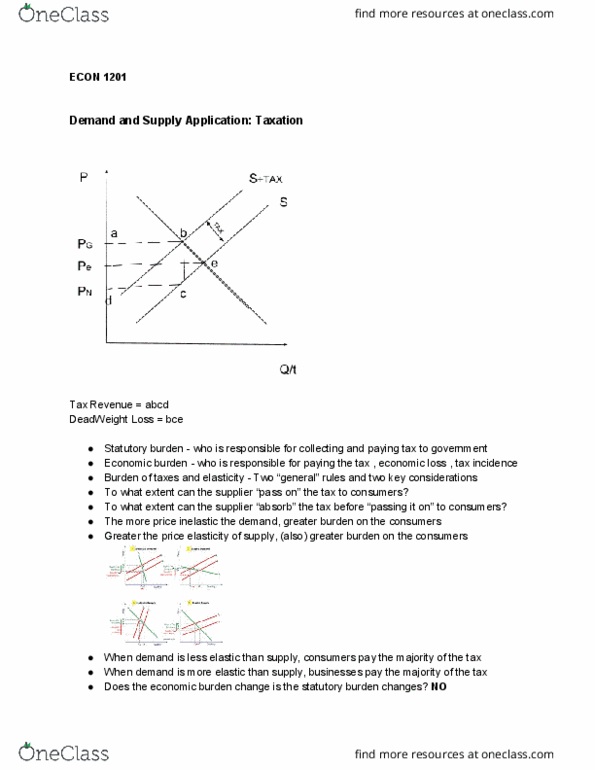

Announcements: johnson will be hosting extraordinary achievement sessions every. Wednesday 4:30-6:00 (tips to get this extra credit: do better on your final than your midterm, executive summaries are way to improve scores, starting friday special office hours) Taxes make divergence between price consumers pay and price suppliers pay. Statutory burden: those who actually has to implement the tax (collect and give to gov) Economic burden: tax incidence, who actually loses consumer or producer surplus. Loss from the tax is greater than actual tax revenue creates. Based off price elasticity of supply and demand. The more price inelastic demand, the greater the burden on consumers. Consumers aren"t sensitive to change in prices. Perfectly elastic: producers bear the full burden (if producers shifted burden onto consumers, they would lose all consumers) As supply becomes more elastic, burden falls on consumers. Government puts burden on sellers to collect the tax b/c it is easier to tax them.