EC140 Lecture Notes - Lecture 7: Pension, Mixed Economy

EC140 verified notes

7/9View all

Document Summary

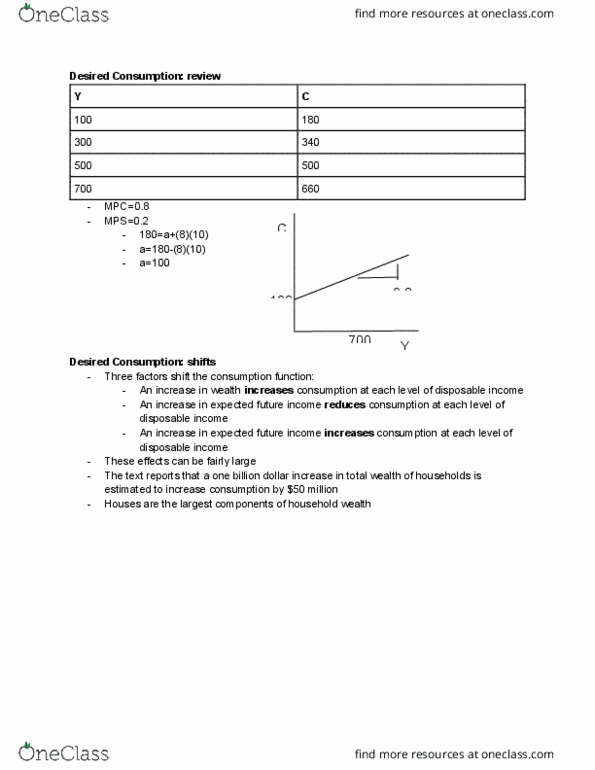

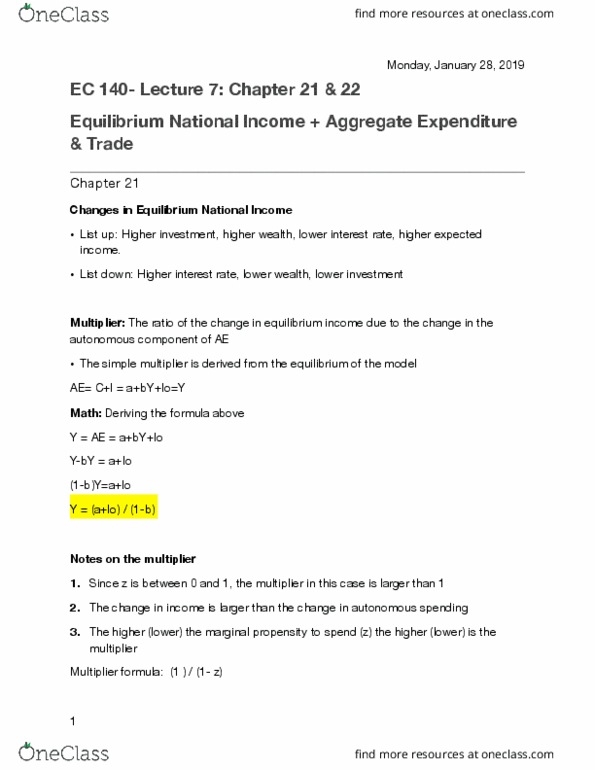

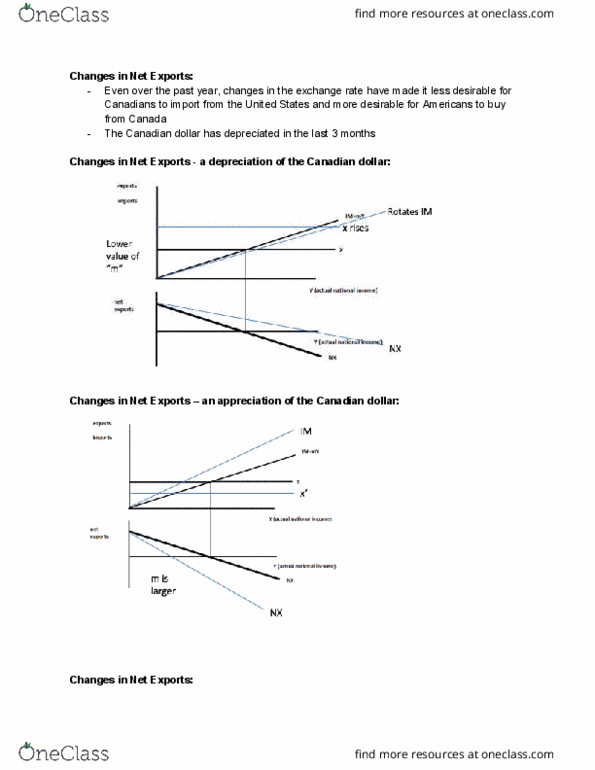

Ec 140- lecture 7: chapter 21 & 22. Changes in equilibrium national income: list up: higher investment, higher wealth, lower interest rate, higher expected income, list down: higher interest rate, lower wealth, lower investment. Multiplier: the ratio of the change in equilibrium income due to the change in the autonomous component of ae: the simple multiplier is derived from the equilibrium of the model. G has a clear direct e ect on ae- it is one of its components. If g increases by ae will increase by (all else held constant) Taxes examples: personal income tax, corporate income taxes, sales tax. Monday, january 28, 2019: excise taxes on products. Transfers examples: old age pension, welfare disability, new child transfer. Intuition: almost all taxes rise with income or spending. Transfers that are clearly sensitive to income are e. i payments & welfare. Desired exports (x)exports depends on decisions made by foreigners and are.