|

|

| |

| Which of the following employment situations would most closely approximate a monopsony? |

|

|

| |

a steel mill in Yokahama, Japan. |

| |

a fast food restaurant in a big city. |

| |

a farmer hiring seasonal workers. |

| |

a large factory in a small town. |

|

|

|

|

|

|

|

|

|

|

| |

| If a monopsonist hires labor, it will choose to hire that quantity at which ___________ and pay a wage rate that is _______________. |

|

|

| |

MR = MC; equal to the MRP curve. |

| |

the supply curve intersect the MRP; less than MFC |

| |

MRP = MFC; less than MRP |

| |

the supply curve intersect the MRP; equal to MRP |

|

|

|

|

|

|

|

|

|

|

| |

| Suppose a firm employs both labor and capital. If the ratio of marginal product to price of labor is 50/$10 and the ratio of marginal product of capital to price of capital is 60/$12, the firm should |

|

|

| |

maintain the current combination capital and labor. |

| |

buy more labor and less capital because labor is cheaper. |

| |

buy more capital and less labor because capital is cheaper. |

| |

buy more capital because it is more productive than labor. |

|

|

|

|

|

|

|

|

|

|

| |

|

Derived demand for labor means that when a firm hires labor, it has to derive its demand |

|

|

| |

mathematically. |

| |

based on the labor supply. |

| |

from the demand for the product that the labor produces. |

| |

based on the minimum wage. |

|

|

|

|

|

|

|

|

|

|

| |

| For a firm in perfect competition, the value of the marginal product is |

|

|

| |

the value of an additional unit of output measured in terms of additional cost. |

| |

the total value of the total output output divided by the total output. |

| |

additional revenue minus additional cost as a result of an increase in output. |

| |

the price of the product multiplied by the additional output resulting from an additional unit employed. |

|

|

|

|

|

|

|

|

|

|

| |

| A firm that is perfectly competitive will hire labor as long as which of the following is true? |

|

|

| |

VMP < W. |

| |

VMP > W. |

| |

MC > MR. |

| |

VMP < MRP. |

|

|

|

|

|

|

|

|

|

|

| |

| The VMP curve slopes downward at some point because |

|

|

| |

congestion in the work place lowers marginal product. |

| |

teamwork in the work place increases marginal product. |

| |

the firm hires less labor as the wage rate rises. |

| |

labor supplies less amounts of labor as the wage rate falls. |

|

|

|

|

|

|

|

|

|

|

| |

| Which of the following would not be considered capital in a business? |

|

|

| |

The employees |

| |

The factory |

| |

A machine |

| |

Tools |

|

|

|

|

|

|

|

|

|

|

| |

| The increase in the value of a firmâs capital as it increases in age and use is depreciation. |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| On a labor market graph, a firmâs demand for labor is |

|

|

| |

the wage rate. |

| |

the marginal revenue product curve. |

| |

the marginal product curve. |

| |

indeterminant. |

|

|

|

|

|

|

|

|

|

|

| |

| Why may a householdâs labor supply curve bend backwards at some wage rate? |

|

|

| |

The household substitutes labor for leisure. |

| |

The household substitutes leisure for labor. |

| |

Employers demand fewer employees at higher wage rates. |

| |

Households want to supply more labor as the wage rate decreases to maintain incomes. |

|

|

|

|

|

|

|

|

|

|

| |

| The substitution effect is usually stronger than the income effect, thus creating an upward sloping labor supply curve. |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| An inelastic demand for labor means that an increase in the wage rate causes a less than proportionate decrease in the quantity of labor demanded. |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Marginal revenue product is |

|

|

| |

marginal revenue divided by marginal product. |

| |

marginal revenue times marginal product. |

| |

marginal product minus marginal revenue. |

| |

marginal product plus marginal revenue. |

|

|

|

|

|

|

|

|

|

|

| |

| A firm obeys the least-cost rule by equating the ratios of ___________________ to the ________________ price. |

|

|

| |

marginal product; product |

| |

marginal product; factor |

| |

marginal cost; product |

| |

marginal revenue; product |

|

|

|

|

|

|

|

|

|

|

| |

| Suppose the MP of the last unit of capital hired equals 12 and the MP of the last unit of labor hired equals 16.If the price of capital is $8 per unit and the price of labor is $8 per unit, then the firm |

|

|

| |

is maximizing its costs with this combination of factors. |

| |

is maximizing its profits with this combination of factors. |

| |

should hire more labor and less capital in order to minimize its costs. |

| |

should hire more capital and less labor in order to minimize its costs. |

|

|

|

|

|

|

|

|

|

|

| |

| For a firm to minimize its costs with more than one factor of production, for every factor, the ratio of the |

|

|

| |

marginal product to factor price must be equal. |

| |

marginal revenue product to factor price must be equal. |

| |

marginal revenue product to output must be equal. |

| |

marginal cost to factor price must be equal. |

|

|

|

|

|

|

|

|

|

|

| |

| A monopsony is a firm that, in a specific market, is the only |

|

|

| |

seller of a product. |

| |

buyer of a product. |

| |

seller of a factor of production. |

| |

buyer of a factor of production. |

|

|

|

|

|

|

|

|

|

|

| |

| Which of the following businesses would most closely approximate a monopsonist? |

|

|

| |

A steel mill in Pittsburgh |

| |

A fast food franchise in a large city |

| |

A large manufacturer in a rural county |

| |

A rancher who hires ranch help |

|

|

|

|

|

|

|

|

|

|

| |

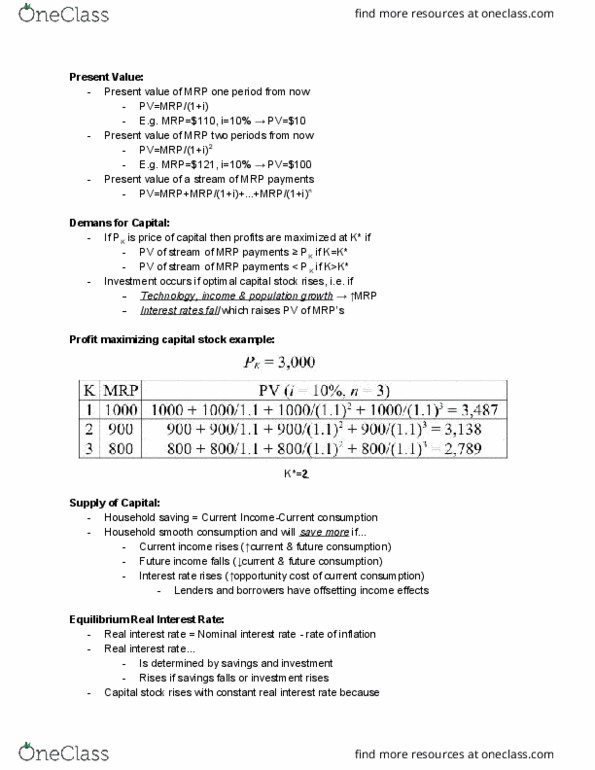

| A firm has the opportunity to buy a machine that costs $2500. It has found the present value of the income generated by the machine to be $2487. It should purchase the machine. |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| An increase in the market rate of interest causes |

|

|

| |

a leftward shift in the demand for capital curve. |

| |

a rightward shift in the demand for capital curve. |

| |

a movement up the demand for capital curve. |

| |

a movement down the demand for capital curve. |

|

|

|

|

|

|

|

|

|

|

| |

| The characteristic of capital that makes it different from labor is its |

|

|

| |

high cost. |

| |

durability. |

| |

rotunda. |

| |

relatively low cost compared to labor. |

|

|

|

|

|

|

|

|

|

|

| |

| The present value of $1000 one year in the future at a 10 percent interest rate is approximately |

|

|

| |

$870. |

| |

$909. |

| |

$1000. |

| |

$1909. |

|

|

|

|

|

|

|

|