LAW 703 Study Guide - Final Guide: Royal Lepage, Fiduciary, Fundamental Breach

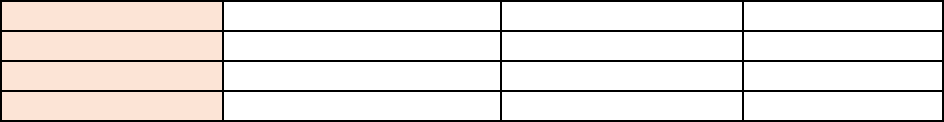

Main Topic Issue Case Holding

Title Insurance Gemeinhardt V. Babic

Title Insurance

Nadvornianski V.

Stewart Title Guaranty

Company

Land Titles Act,

Principles

Durrani V. Augier

Fraud, Deferred

Indefeasibility

Durrani V. Augier

Augier and Zettlers

got no interest,

Bank did

(innocent). Bank

mortgage remains,

Durranis remain

owners.

Land Titles Act,

Trusts

Di Michelle V. Di

Michelle

Actual Notice

Doctrine, Land Titles

Act

United Trust V.

Dominion

Fraud, Deferred

Indefeasibility

CIBC V. Computershare

A person’s interest

is now defeasible

only if that person

received their

interest from a

fraudulent person=

being a forger or

fictitious person.

Rabi V. Rosu

Immediate

Indefeasibility

Household Realty Corp

V. Liu

Fraud

Lawrence V. Maple

Trust

Fraud, Double

deferred

Indefeasibility (NO

LONGER A THING)

Reviczky V. Meleknia

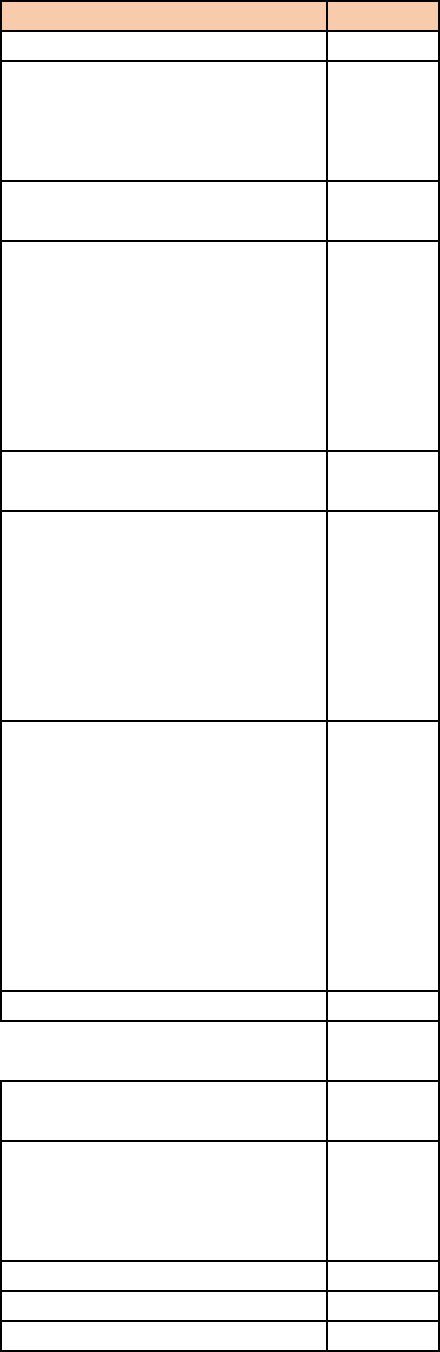

Reasoning Page

Bare trustee can make a claim

on behalf of beneficiaries and

beneficiaries can make claim

once proved

828

Durrani’s are true owner and

Augier is fraudster. Fraudster

sold house to Zettlers who had

actual/deemed notice of fraud.

Zettler got a mortgage from

bank. Bank has no notice of

fraud.

857

835

Leases for over 3 years must be

registered. Dominion used the

actual notice doctrine to save

their unregistered lease of over

3 years – the purchaser had

actual notice of the lease

before purchase.

839

If the forger or his or her

accomplice goes on title in his

or her own name, the innocent

person who takes title from the

forger or accomplice will get

good title. If a fictitious person

goes on title – innocent person

will not get good title

896

871

866

Opportunity to Avoid Trust 878

Bank could have avoided fraud

with Due Diligence

887

Document Summary

A person"s interest is now defeasible only if that person received their interest from a fraudulent person= being a forger or fictitious person. Bare trustee can make a claim on behalf of beneficiaries and beneficiaries can make claim once proved. Fraudster sold house to zettlers who had actual/deemed notice of fraud. Leases for over 3 years must be registered. Dominion used the actual notice doctrine to save their unregistered lease of over. 3 years the purchaser had actual notice of the lease before purchase. If the forger or his or her accomplice goes on title in his or her own name, the innocent person who takes title from the forger or accomplice will get good title. If a fictitious person goes on title innocent person will not get good title. Bank could have avoided fraud with due diligence. Seller commission was due, conspiracy on part of the buyer. Whether there was a breach of duty of care.