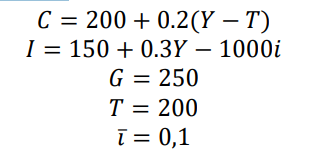

Consider the following IS/LM model:

1. Find the equation of the IS curve of this economy (you must have Y on the left and

everything else on the right of the equation).

2. The central bank sets an interest rate of 10%. How does this decision translate into

in the equations defined above?

3. What is the level of money supply when the interest rate is 10%. Use

the real cash flow demand equation: (𝑀/𝑃)^𝑑 = 2𝑌 − 8000𝑖

4. Find the equilibrium values of C and I and check the result by calculating Y by summing

C, I and G with the values you get.

5. Assume that the central bank lowers its key rate to 10%. What

are the consequences of this decision on the LM curve? Find the balance for Y, I and C,

and explain in a written manner the effects of expansionary monetary policy. What

is the new equilibrium value of 𝑀/𝑃?

6. Let's return to the initial case where the interest rate set by the central bank is 5%.

Suppose that government spending increases so that 𝐺 = 400. Explain the

effects of an expansionary fiscal policy on Y, I and C. What is the effect of an expansionary fiscal policy

expansionary budget on the money supply?

Consider the following IS/LM model:

1. Find the equation of the IS curve of this economy (you must have Y on the left and

everything else on the right of the equation).

2. The central bank sets an interest rate of 10%. How does this decision translate into

in the equations defined above?

3. What is the level of money supply when the interest rate is 10%. Use

the real cash flow demand equation: (𝑀/𝑃)^𝑑 = 2𝑌 − 8000𝑖

4. Find the equilibrium values of C and I and check the result by calculating Y by summing

C, I and G with the values you get.

5. Assume that the central bank lowers its key rate to 10%. What

are the consequences of this decision on the LM curve? Find the balance for Y, I and C,

and explain in a written manner the effects of expansionary monetary policy. What

is the new equilibrium value of 𝑀/𝑃?

6. Let's return to the initial case where the interest rate set by the central bank is 5%.

Suppose that government spending increases so that 𝐺 = 400. Explain the

effects of an expansionary fiscal policy on Y, I and C. What is the effect of an expansionary fiscal policy

expansionary budget on the money supply?