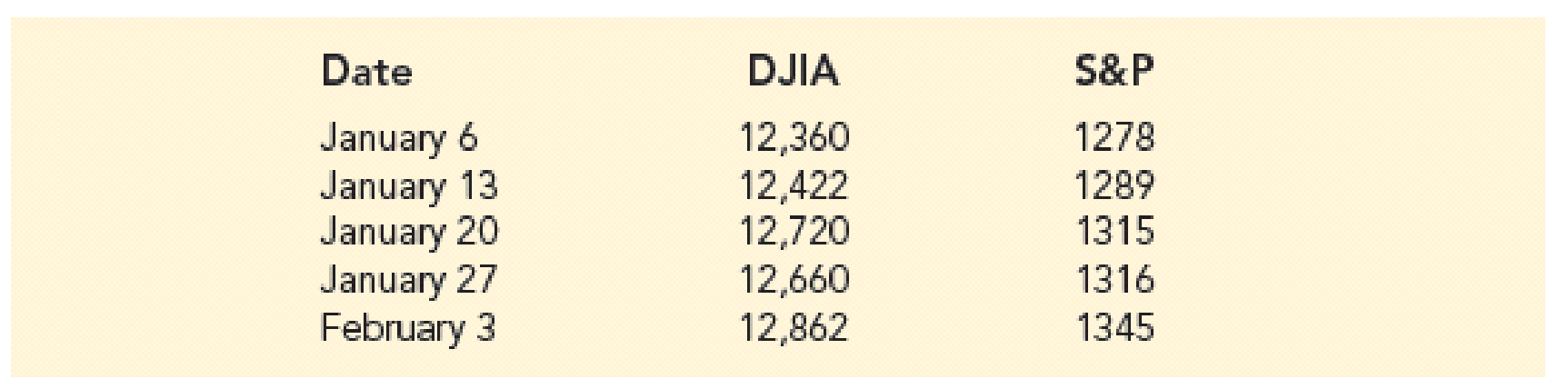

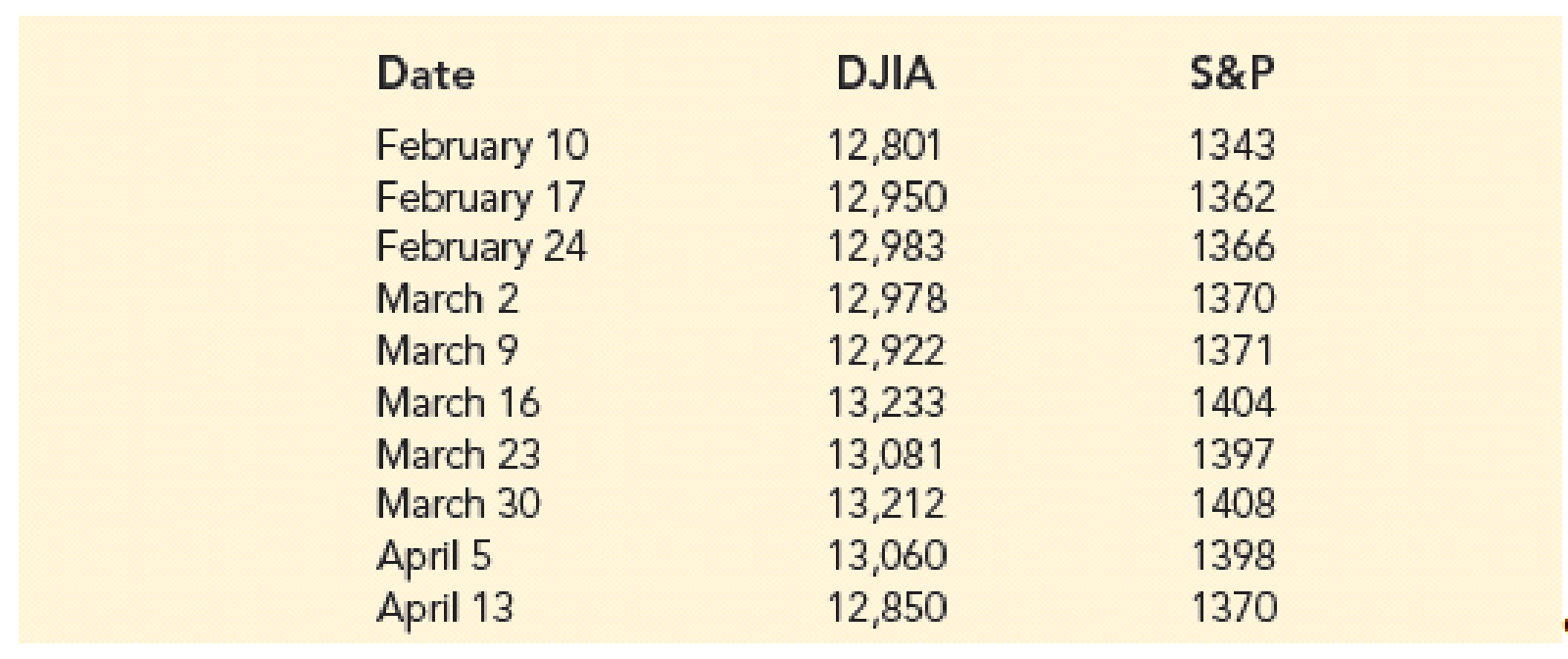

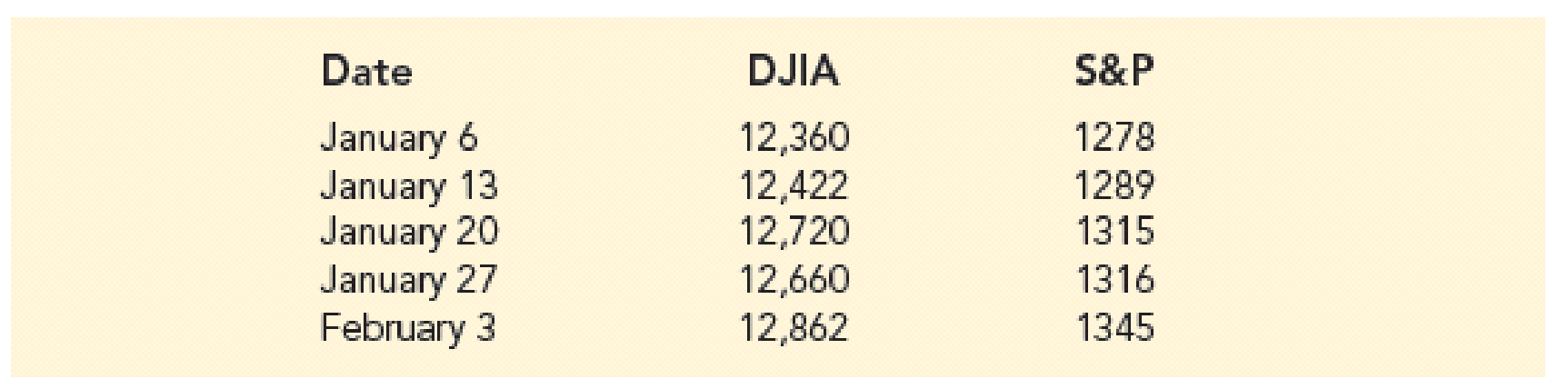

Stock Market Performance: the Dow Jones Industrial Average (DJIA) and the Standard & Poor's 500 (S & P 500) indexes are used as measures of the overall movement in the Stock market. The DJIA is based on the price movements of 30 large companies; the S & P 500 is an index composed of 500 stocks. Some say the S & P 500is a better measure of the stock market performance because it is broad-based. The closing price for the DJIA and the S & P for 15 weeks, of a previous year follow (Barrow's website).

a. Develop a scatter diagram with DJIA as the independent variable.

b. Develop the estimated regression equation.

c. Test for a significant relationship.

d. Did the estimated regression equation provide a good fit? Explain.

e. Suppose that the closing price for DJIA is 13,500. Predict the closing for the S & P 500.

f. Should we be concerned that the DJIA value of 13,500 used to predict the S & P 500 value in part (e) is beyond the range of the data used to develop the estimated regression equation?

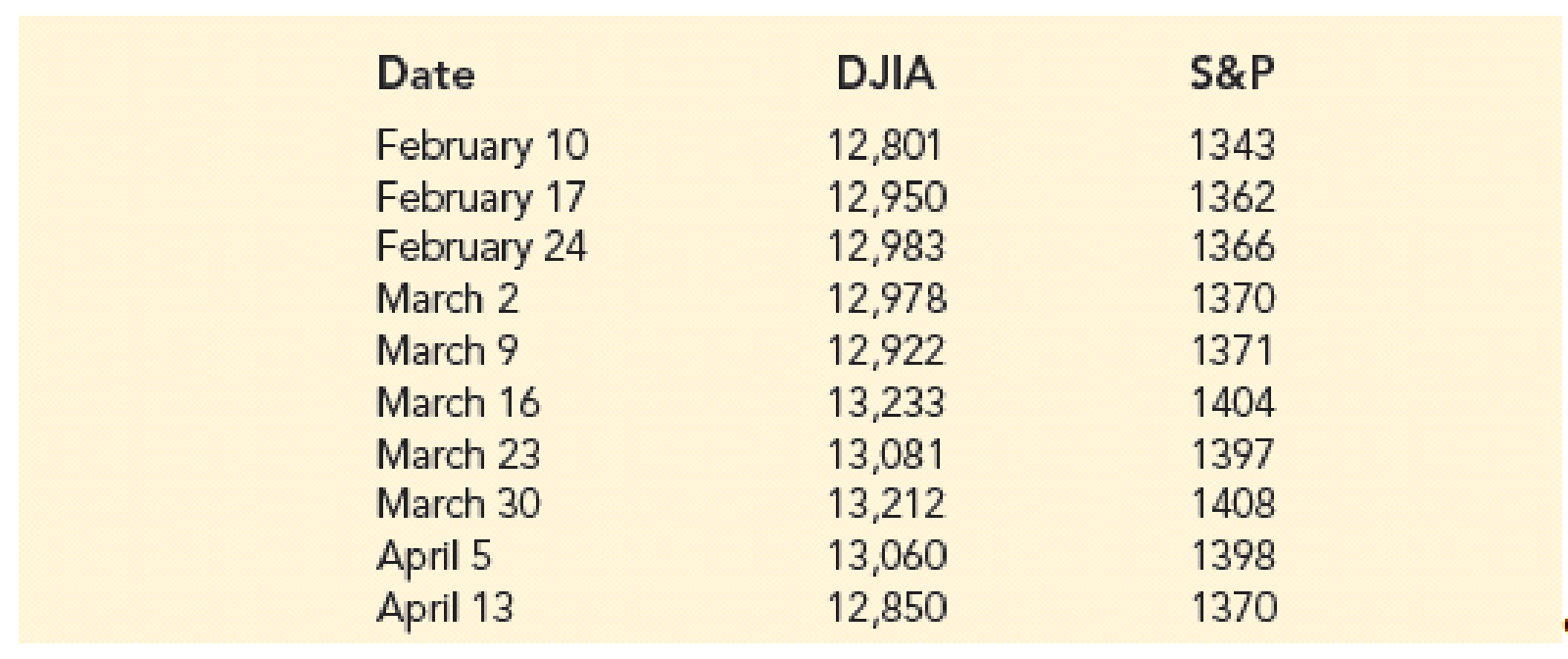

Stock Market Performance: the Dow Jones Industrial Average (DJIA) and the Standard & Poor's 500 (S & P 500) indexes are used as measures of the overall movement in the Stock market. The DJIA is based on the price movements of 30 large companies; the S & P 500 is an index composed of 500 stocks. Some say the S & P 500is a better measure of the stock market performance because it is broad-based. The closing price for the DJIA and the S & P for 15 weeks, of a previous year follow (Barrow's website).

a. Develop a scatter diagram with DJIA as the independent variable.

b. Develop the estimated regression equation.

c. Test for a significant relationship.

d. Did the estimated regression equation provide a good fit? Explain.

e. Suppose that the closing price for DJIA is 13,500. Predict the closing for the S & P 500.

f. Should we be concerned that the DJIA value of 13,500 used to predict the S & P 500 value in part (e) is beyond the range of the data used to develop the estimated regression equation?