BUS-F 420 Lecture Notes - Stock Valuation, Profit Margin, Dividend Payout Ratio

Document Summary

Get access

Related Documents

Related Questions

Question 1:

Using conditioning theory as your guide, why was the training program not more effective?

1) The conditioning process emphasizes the importance of consequences of behaviour—in this case, there did not seem to be any consequence (positive or negative) to the supervisors learning or applying what they were supposed to learn in their training.

2) The conditioning process emphasizes the importance of consequences of learning. In this case, there did not seem to be any consequence (positive or negative) to the supervisors performance.

3) The conditioning process emphasizes the importance of consequences of performance—in this case, there did not seem to be any consequence (positive or negative) to the supervisors performance.

4) The conditioning process emphasizes the importance of consequences of cost—in this case, there did not seem to be any consequence (positive or negative) to the reward model.

5) None of the above.

Question 2

How could the program be improved by using some of the concepts, principles, and components of conditioning theory?

1) Consequences for applying the skills acquired (positive or negative reinforcement) might have improved the training outcomes significantly.

2) Positive role modelling might have improved the training outcomes significantly.

3)Senior leaders in the training modelling the training behaviours might have improved the training outcomes significantly.

4) A thorough organizational analysis might have improved the training outcomes significantly.

5) None of the above.

Learning & Motivation

Nurse supervisors at a large hospital seldom conducted performance appraisal interviews and some refused to do them. They complained that there was no time to meet with every nurse, and that it was a difficult, time-consuming, and unpleasant process that was a big waste of time. Some were uncomfortable with the process and found it to be stressful for everybody involved. They said it caused a lot of anxiety for them and the nurses.

However, the administration was in the process of introducing a new model of nursing that required all nurses to perform certain critical behaviours when interacting with and counselling patients and their families. It was therefore imperative that performance appraisals be conducted to ensure that nurses were implementing the new model of nursing and performing these critical behaviours.

The nurse supervisors would be required to evaluate their nurses’ performance every six months and then conduct a performance appraisal interview with each nurse in which the previous six months’ performance would be discussed. An action plan would then be developed with specific goals for improvement.

The administration decided to hire a performance management consultant to provide a one-day workshop on how to conduct performance appraisals for all nurse supervisors. The training program was mandatory and all nurse supervisors had to attend. Many of them did so reluctantly, complaining that it would be a waste of time and that it would not make any difference in how things were done in the hospital.

The training program began with a lecture on performance management and how to conduct performance appraisal interviews. The consultant first explained that the purpose of a performance appraisal interview is to give feedback to employees on how well they are performing their jobs and then plan for future growth and development. He then discussed different types of performance appraisal interviews such as the “tell-and-sell interview,” the “tell-and-listen interview,” and the “problem-solving interview.” This was followed by a list of guidelines on how to conduct effective interviews, such as asking the employee to do a self-assessment, focusing on behaviour not the person, minimizing criticism, focusing on problem solving, and being supportive. The trainees were then instructed on how to set goals and develop an action plan for improvement.

After the lecture, the trainees were asked to participate in a role play in which they would take turns playing the part of a supervisor and an employee. They were provided with information about a nurse’s job performance to discuss in the role play and then develop an action plan. However, some of the trainees left the session, refusing to participate. Others did not take it seriously and made a joke out of it. There was a lot of laughing and joking throughout this part of the program. After the role play there was a group discussion about the role play followed by a review of the key points to remember when conducting performance appraisal interviews.

Although the supervisors were supposed to begin conducting performance reviews and interviews shortly after the training program, very few actually did. Some said they tried to do them but could not find time to interview all of their nurses. Others said that they followed the consultant’s guidelines but they did not see any improvement in how they conducted interviews or in how nurses reacted to them. Some said it continued to be a stressful experience that was uncomfortable for them and the nurses, so they decided to stop doing them.

One year later, performance appraisals were still a rare occurrence at the hospital. Furthermore, many of the nurses were not practising the new nursing model and, as a result, nursing care and performance were inconsistent throughout the hospital and often unsatisfactory.

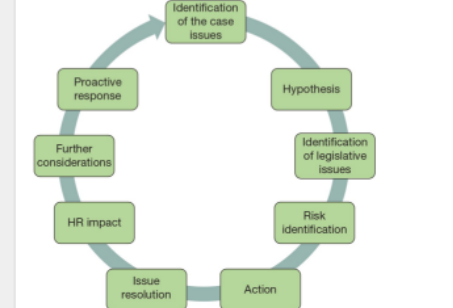

Using the above thought cycle as a guide, we are able to consistently analyze the case study:

| Stage |

Analysis

|

| Identification of the Case Issues: | Performance appraisals for nurses, to be done by nursing supervisors, were not being completed. A new model of performance appraisal was introduced based on mandatory changes to the existing nursing model. Training conductive performance appraisals for nursing supervisors was provided by an external consultant. Only cne training session was provided, which was mandatory. Participants did not take the training cession seriously. The performance appraisal process was not effective after one year of implementation. The new model of nursing care was not successfully implemented. |

| Hypothesis |

Performance appraisals are perceived as a negative experience and a waste of time and are not valued. This perception needs to change in a positive way.

|

| Identification of legislative issues | In this case compliance with the Human Rights Code, employment standards legislation, occupational health and safety legislation and applicable collective agreements are all relevant. The employer must ensure that any performance issues are managed properly and in compliance with each legislative requirement. |

| Risk Identification: | If the new model of nursing care is not implemented successfully,

patients care could suffer with potentially devastating and tragic consequences. Patients, other staff, and the hospital as a whole could be at risk of legal challenges and lawsuits based on potential nursing negligence and liability claims.

|

| Action: | The hospital needs to change the cultural approach to performance appraisals first. There must be a clear identification of how performance appraisals can and should be used as a positive motivator in order to effect employee changes in behaviour. Performance management must align with the required changes to the model of nursing care. The hospital should create a comprehensive performance management training program that includes participation with supervisory and frontline nursing staff at each step of the planning process through to successful implementation. |

| Issue Resolution: | A performance management system developed for nurses by nurses will encourage participation and engagement with required supervisory training programs, which will be perceived as a positive experience for everyone involved. |

| HR Impact: |

HR must work in partnership with designated nursing staff to implement changes to nursing model standards and develop new performance management metrics. At the same time, HR must provide leadership in the design and delivery of an effective training program for performance management by nursing staff for nursing staff. |

| Further considerations: | How can the hospital ensure that the performance management process continues to move forward in a constructive way? |

| Positive Response: | Ongoing support, from HR and through continuing training sessions, must be provided to supervisory nursing staff so that they can commit time and focus on the performance management process. |